Different types of banks can be used for different types of purposes. When it comes to organizing and enjoying your travels, having the appropriate kind of bank account can make all the difference. Unexpected expenses or a lack of access to banking services are the last thing you want to happen to your vacation plans.

As a traveling couple, you need to choose the right bank to ease your stress while traveling to avoid exorbitant expenditures or lack of access.

I believe you should be aware that your bank is saddling you with outrageous fees and a bad exchange rate each time you use your card abroad. However, selecting the appropriate bank might save you thousands of dollars a year.

We have examined a good number of bank accounts over the last few years and determined which are the best for travel. These bank accounts will undoubtedly help you save money after you’ve spent hundreds on pointless fees and minimums.

So whether you’re looking for cashback on accommodation or free ATM withdrawals abroad, this guide will help you choose the best bank for low budget traveling couples.

12 Best Bank for Low Budget Traveling Couple

1. Wise

Looking for a bank that will not disappoint you on your trip? Choose Wise. Wise, formerly known as Transferwise, is one of the most well-known brands in international banking and fintech worldwide. With the ability to save money in more than 50 currencies, Wise is the financial product that most closely resembles a truly worldwide service, which is why it deserves special recognition.

There are only a handful of countries (about a dozen) in which Wise cannot be used at all, and a few more in which you are unable to receive their free borderless multi-currency accounts.

You can also use the Wise debit card, which has some of the lowest affordable fees for foreign purchases, in a lot of countries.

The feature of Wise that I like the best is that they give you access to local banking information in many different countries (such as Europe, the US, Australia, Singapore, and many more), which makes it simple to accept payments from friends or clients who are located anywhere in the world without incurring additional fees or delays.

Wise pros

- Quick and simple account setup

- Reasonable exchange rates and inexpensive fees

- Reliable and doesn’t conceal costs

- Accounts are international and enable money transfers from practically any place.

- You can now earn competitive interest on your deposits while still being able to access the funds freely

Wise cons

- 3D Secure online payments are not currently supported for US-issued cards

- Only accounts based in the US, Singapore, the UK, and the EU/EEA are now eligible for interest, and rates differ by location.

- Quite basic budgeting features, although they now offer a money jar feature

2. Charles Schwab checking account

One of the best international banks that I recommend for you as a traveler is the Charles Schwab Checking Account.

This is our top choice when it comes to checking accounts for international withdrawals. This checking account has several advantages, including the fact that there are no out-of-network ATM costs and that you get reimbursed for ATM expenses that are incurred by the machine itself!

This implies there are no additional fees associated with taking out money almost anywhere in the world. This account is an excellent choice for a checking account for overseas travel because it has no minimums or additional fees. In addition, they give you a 0.03% interest rate on the amount in your checking account, which most checking accounts don’t.

Charles Schwab checking account pros

- No opening deposit

- There is no minimum account balance

- Unlimited out-of-network ATM reimbursements

- No foreign transaction fees

- Free overdraft protection

Charles Schwab checking account cons

- No way to deposit cash

3. Monzo

For individuals looking for a travel card with affordable ATM fees and capped overdraft costs, Monzo is a very popular choice. With Monzo, you can conveniently spend your money at Mastercard’s exchange rates, anywhere and in any currency.

Monzo’s classified spending system, which allows you to track your expenses by transaction type, is one of its most important features. You can use this approach to analyze your spending trends, pinpoint the areas in which you spend the most, and modify your budget as necessary.

Additionally, Monzo offers a feature called “smart savings,” which rounds up your purchases and saves the difference. As you save money for that unique vacation, you can choose to keep these savings segregated for easier administration and monitoring. You can even earn interest on them.

You can withdraw £200 free of charge with your Monzo card every 30 days from outside the European Economic Area (EEA). After that, each ATM withdrawal will cost you 3%. This cap increases to £400 if you have a Monzo Plus subscription and to £600 if you have a Monzo Premium subscription.

As long as Monzo serves as your primary bank account, you can withdraw money from the EEA without incurring any fees.

When you wish to divide vacation expenses with others, the Shared Tab function makes it simple to come to a decision. Additionally, Monzo Premium offers travelers other perks, including phone and travel insurance, as well as a discount on airport lounge access.

Monza pros

- Fee-free payments abroad

- Arranged and unarranged overdrafts

- Instant Access Saving Pots to help you save for your travels at a 4.1% AER interest rate

Monza cons

- £1 fee for PayPoint cash deposits

- Receiving international money transfers isn’t reliable

- There are varying ATM withdrawal limits abroad

4. CAPITAL ONE 360

We try to save by using the Capital One 360 account for ATM withdrawals as a last resort, as it doesn’t reimburse ATM costs (although it doesn’t charge for using an ATM outside the network).

They do, however, have a fantastic mobile app that makes it simple to pay bills, transfer funds to other accounts via Zelle, and secure your card in case it is misplaced or stolen. They don’t impose any fees and don’t have any minimal criteria. The best aspect is that their interest rate, which is “high” for checking accounts at 0.10%, is rather low. Additionally, you can open a 1.75% interest-bearing Capital One 360 savings account and easily move funds between the two.

Capital One 360 pros

- 0.10% APY on all account balances

- There is no opening deposit or minimum account balance

- There is no monthly service fee

- There is no foreign transaction fee

- Range of overdraft protection options

- Processes direct deposits up to 2 days early

Capital One 360 cons

- Doesn’t reimburse out-of-network ATM fees

- Limited access to customer service by phone

5. Starling Bank

Renowned for its reasonable and competitive interest rates, Starling Bank is a great option for both local and foreign transactions. Notably, there are no fees for consumers who use an ATM or conduct transactions outside of their country. This stands in stark contrast to several rivals, like Revolut, which imposes a 2% fee on card purchases that exceed a predetermined threshold.

Starling is a UK-based digital-only bank that serves customers that are at least 16 years old. The bank now offers commercial and joint bank accounts in addition to personal accounts, all of which can be controlled via its cutting-edge, user-friendly app.

Deposits up to £85,000 are covered under the Financial Services Compensation Scheme thanks to its UK banking license. Additionally, Starling offers interest on balances up to $5,000 at 3.25% AER. Alternatively, you can invest anywhere between £2,000 and £1 million for a return of 5.36% in a 1-year fixed saver if you want to save for a major trip.

Starling Bank pros

- Fee-free ATM withdrawals and payments abroad

- Mastercard’s exchange rates for transactions in foreign currencies

- Earn interest of 3.25% AER

Starling Bank cons

- Interest payments are capped at deposits of £5,000 or less

- £10 fee for sending a replacement card abroad (if possible)

- Variable overdraft interest rates (15%, 25%, or 35% AER)

6. Bask Bank Interest Savings Account

The strong annual percentage yield (APY) of the Bask Bank Savings Account helps it to rank as one of the best bank for low budget traveling couples.

With a high rate of 5.10%, Bask is competitively priced and enhances the raw value of your balance. The more interest you earn, the sooner you’ll be able to take your dream vacation. Furthermore, there are no minimum opening or balance restrictions to begin building your savings.

Bask Bank Interest Savings Account pros

- Strong 5.10% APY

- No minimum opening deposit

Bask Bank Interest Savings Account cons

- No joint accounts

7. American Express High Yield Savings Account

One excellent savings account to generate money on all of your trip savings is the American Express High Yield Savings Account. This account is an excellent way to start saving money because it has no fees, deposits, or minimum balance requirements. To help you save even more, it also features one of the highest interest rates on the market, 1.65%. Sending money across more accessible accounts is simple when you use your Amex account to access your account.

American Express High Yield Savings pros

- Interest Rate: 1.65%

- Minimum Balance: None

- Additional Fees: None

- Competitive 4.35% APY

- $0 minimum opening deposit

- 24/7 customer support

American Express High Yield Savings cons

- No in-person support

- No mobile check deposits

Also, Read BEST CUTE COUPLE TRAVEL CAPTIONS FOR INSTAGRAM

8. Revolut

Revolut offers affordable foreign financial services with no monthly service fees for its Standard plan and no minimum deposit required to start an account. Revolut provides competitive exchange rates, based on market rates collected from third-party sources on weekdays, with a narrow spread between the buy and sell prices.

There are no costs for the first £1,000 of currencies exchanged each month. Nevertheless, there is a 0.5% fee for the Plus plan and a 1% fee for the Standard plan for any amount over this cap. Regardless of the account plan, fixed exchange rates are applied with a markup on weekends.

Cashback on lodging is available to Revolut members, and extra incentives for travelers on more expensive plans include access to airport lounges and insurance for rental cars, medical expenses, trip cancellation, delayed flights, misplaced luggage, and winter sports.

Revolut offers banking features that are on par with, or better than those of traditional banks. Setting monthly budgets and spending targets for several categories, such as dining out or shopping, makes it simple to keep tabs on your expenditures. In certain regions, Revolut cards can be linked to Apple or Google Pay and facilitate direct debits in GBP.

Revolut pros

- Fee-free account

- Fee-free money transfers Mon-Fri (subject to limits)

- Savings interest

- Budgeting tools

Revolut Bank cons

- Less competitive exchange rates

- Large transactions mean higher fees

- Doesn’t offer full banking services (no overdraft)

9. Ally Bank Savings Account

Ally Bank’s excellent 4.25% APY and automated savings capabilities help it to the top of our list of vacation savings accounts. With Ally, you may divide your account balance into many savings accounts, which is ideal for putting money down for a future trip. When you link an Ally checking account and enable automatic transfers into your accounts, you can also set up roundups, which will let you save for that trip without having to do any work at all.

Ally Bank Savings Account pros

- Strong 4.25% APY

- No minimum opening deposit

- Three savings tools

Ally Bank Savings Account Cons

- Must fund account within 30 days to avoid closure

- No cash deposits

Also, Read 20 BEST LOW BUDGET PLACES TO TRAVEL

10. SoFi Checking and Savings

One of the best banks for low budget traveling couples for a vacation savings account is the SoFi Checking and Savings package, thanks to the flexibility and versatility it offers through both accounts.

This account comes with savings roundups and cashback offers that round up your purchases and deposit the excess money into a savings vault you create.

Additionally, you can make up to 20 of these vaults to help you keep track of your various savings objectives. The accounts can additionally earn 4.60% on savings and 0.50% on checking if direct deposits are set up or if a minimum of $5,000 is deposited each month. SoFi now provides up to $2 million in additional FDIC coverage.

SoFi Checking and Savings Pros

- Earn 0.50% APY on checking

- Up to 4.60% APY on savings

- Up to 15% back on purchases with participating merchants

- Savings roundups

SoFi Checking and Savings Cons

- $4.95 for cash deposits

- Deposit requirements for best APY

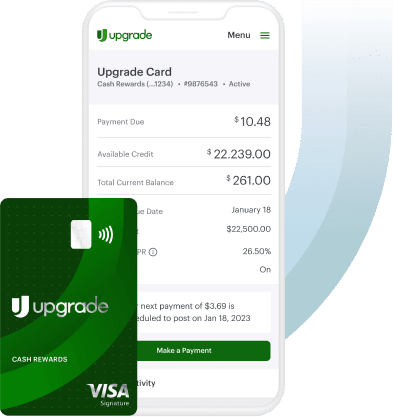

11. Upgrade – Premier Savings

Upgrade Savings is one of the top options on our list because of its attractive 5.21% APY, which is a crucial benefit for getting you closer to your trip sooner. Furthermore, there are no monthly fees associated with Premier Savings accounts. Plus, you can start earning interest as soon as the money is deposited into your account because you get same-day transfers. Additionally, there is no minimum opening requirement, but to begin collecting interest, you must have $1,000.

Upgrade – Premier Savings pros

- High 5.21% APY

- No minimum opening requirements

- Same-day transfers

Upgrade – Premier Savings cons

- Not available to existing Upgrade Rewards Checking or High Yield Savings customers

- You need at least $1,000 to start earning interest

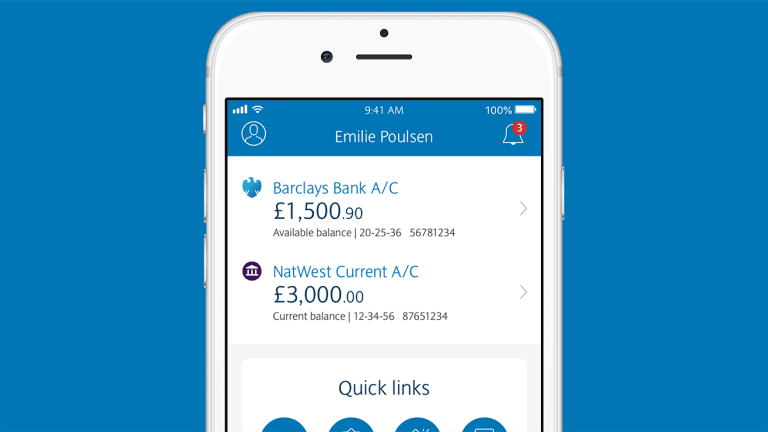

12. Barclays Online Savings

Barclays stands out from the other vacation savings accounts on our list because there is no monthly transaction limit. This Barclays account is a flexible alternative if you’re not sure you’ll need to take out a loan before your vacation, as most savings accounts only allow you to make six monthly transactions.

When you have the option to choose Barclays, you don’t necessarily need the worry that certain banks cause. It’s time to put Barclays Online Savings on your list of the top banks for couples on a tight budget when they travel.

Barclays Online Savings prons

- Competitive 4.35% APY

- No maximum deposit balance

- No monthly transaction limit

Barclays Online Savings cons

- No cash deposits

- Five-day hold on deposits